Last Updated on February 15, 2025

Claiming Expenses When Working from Home? Make Sure You Have a Receipt Parser

Many of us are returning to work. Some of us aren’t. What cannot be denied about the coronavirus pandemic is the uncertainty that it has caused.

This uncertainty has filtered into every area of our lives. Remote working has become the new normal. People have been grappling with bad internet connections and adapting to the etiquette of virtual business meetings, to name just two the changes to our working lives.

Politicians have been clear that they want people to return to work as quickly as possible. However, it looks like social distancing will continue to be a feature of all our lives for quite some time. Many businesses may well decide to mitigate the costs of costs of having office-based employees by extending remote working policies for months, years… or even indefinitely!

However, employer’s obligations to paying for expenses will remain the same. So, if you’re unsure of your rights and what you need to do to make sure that you can claim for expenses, or if investing in receipt parser technology is the right decision, we’ve got the lowdown for you.

Employer Reimbursements: Working from Home… Time to Invest in Receipt Parsing Technology

Employers can reimburse employees who are required to carry out their role from home. For employees to be eligible, they must be regularly performing some or all their duties from home – not just working from home on evenings and weekends.

Guidelines may differ from country to country, but employers are responsible for making home working expense claim arrangements with their employees themselves. Typically, any terms must be agreed in writing, however in many countries anyone forced into working from home will qualify.

How do employers make life easier for themselves? By investing in a receipt parser. This allows employees to capture and upload their expenses to the cloud, making reimbursement easy and efficient.

What Costs Can Be Reimbursed Thanks to Receipt Parser API?

Any costs that have genuinely increased and necessary for an employee to complete their duties whilst working from home can be reimbursed. This includes heating and lighting bills, metered water costs and in some cases internet access.

Should any employees have to buy software to complete their duties from a home computer, these expenses can also be reimbursed. However, mortgage payments, rent and ground costs are ineligible to be claimed.

The key determiner is whether purchases are wholly necessary to complete the role. So, if an employee would like to have the latest versions of say, Adobe Creative Suite, but can get by with a software iteration that’s a few years old, this wouldn’t be considered necessary and therefore the cost eligible to be reimbursed.

Is General IT Hardware or Software an Expense…? What About a Receipt Parser?

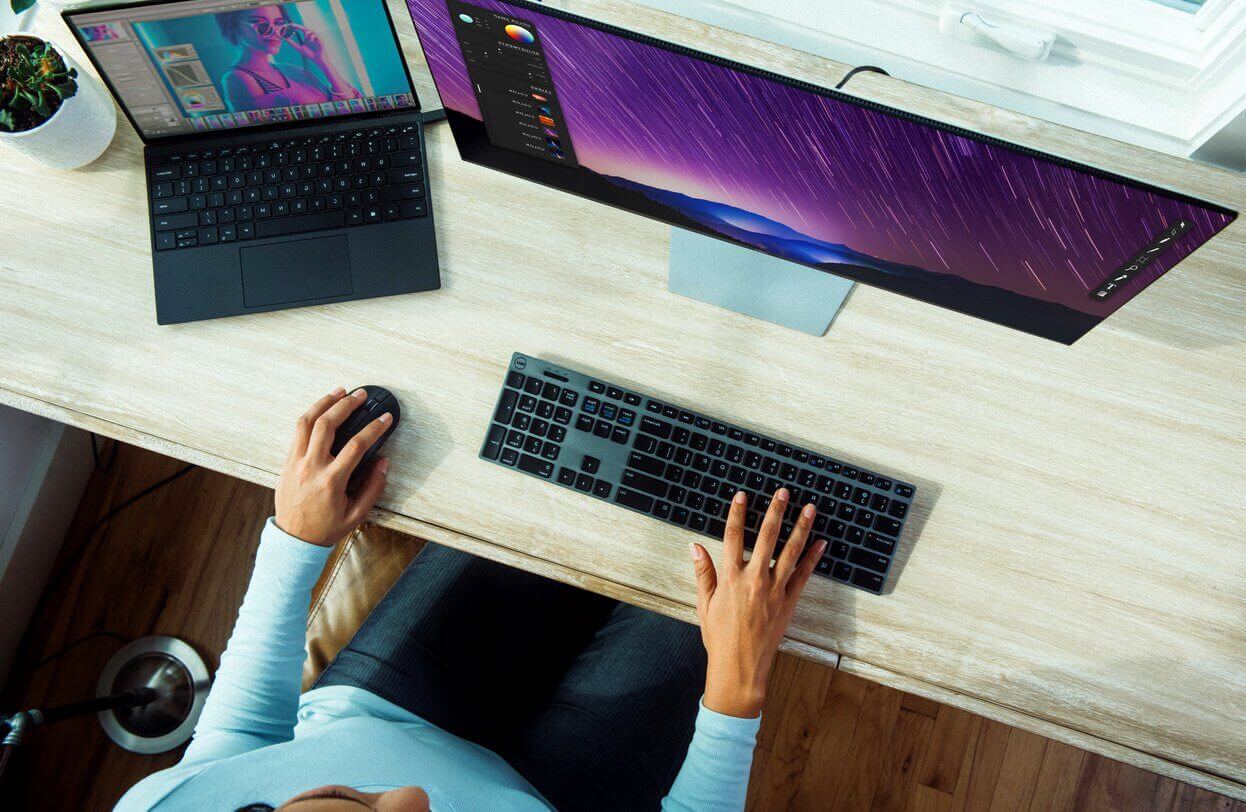

What is considered essential IT software and hardware. Let’s say that you have a Dell laptop with the required software to complete your duties from home. But you want to buy a 2020 Apple MacBook Air because the laptop will make it easier to complete your role. Is this an expense you can claim? Doubtful. However, if an employer agrees to reimburse you the cost of purchase, that’s a different story.

In respect to software, the guidelines are a little simpler. Let’s say you manage the expenses for a large business. Senior management has agreed to reimburse working from home costs to employees. You’ve concluded that investing in receipt parsing technology is the only way to make sure the company can accurately reimburse employee expenses. Is this an expense that you can claim? Yes.

Think of it this way. How are you going to categorise tens, if not hundreds of paper receipts to reimburse each month? And if by some miracle you were able to gather them, would you want to touch them?

Can Employees Claim Tax Relief and Why You Need to Invest in

Again, this may be different depending on where you’re working in the world and your personal circumstance but it’s worth including as it is relevant to expenses reimbursement.

So, for an employee to claim tax relief to cover their expenses, they need to show that they work from home on a regular basis. General guidance says that for employees to qualify for tax relief, any duties carried out at home must be substantial, impossible to perform on an employer’s premises, and cannot be completed without the use of the expenses to be deducted.

In the UK, employees can claim tax relief on certain purchases, however broadband and mobile phone use are not eligible – if businesses provider employees with a mobile phone and SIM card without a restriction on personal use. Uploading in the UK with receipt OCR technology like Tabscanner API is going to ensure all data is accurately parsed in any app.

The USA has outlined various tax reliefs for employers battling the financial effects of the coronavirus called the Coronavirus Aid, Relief and Economic Security Act (or CARES Act), full information can be found here.

Similarly, the UAE has announced measures in Dubai and Abu Dhabi to safeguard citizens and businesses against the financial impact of the coronavirus. If you’re interested in learning more, a concise breakdown of the measures introduced can be found easily on Google.

To secure any reimbursements, it’s standard practice to make sure that you have a proof of payment. So, if you know that you’re likely to have a bundle of receipts or invoices, the best thing to do is to invest in Receipt Parser API and reliable online platforms. Why? What if you lose or discard your receipts? What if the ink fades in the sunlight? How are you going to be reimbursed?

So, the bottom line is if you’re working from home and you know that you’ll be making purchases that you’d like to be reimbursed, invest in receipt parsing technology… after all, can you afford to be out of pocket in such trying economic times?