Last Updated on January 8, 2025

If there’s one word that’s universally-applicable to businesses of all descriptions the world over its progression. Managing directors must, not only make astute decisions with the present circumstances of their business but, have one eye on the future.

This ethos allows businesses to better service their clients, grow their client base and increase revenue. Accountancy practices are no different to any other business. If you want to be successful, and amplify your growth potential, it’s paramount that you optimise technological innovation for multiple purposes.

Luckily in today’s digital age, business owners have a wealth of opportunities to adopt technology into their businesses. From automating processes by using an OCR receipt scanner to embracing mobile working and using technology to excel during crucial quarters, here’s how an accountancy practice can use technology to optimise their growth strategies.

Automate Processes and Achieve Superlative Efficiency – Daily

In 2023, accountancy and bookkeeping practices have access to a wealth of software and applications that allow them to optimise processes.

Tasks can be completed in half, or even a fraction of the time, they may have taken just a few short years ago. Bookkeeping and expense management can be optimised with ease, making managing commercial finances effortless.

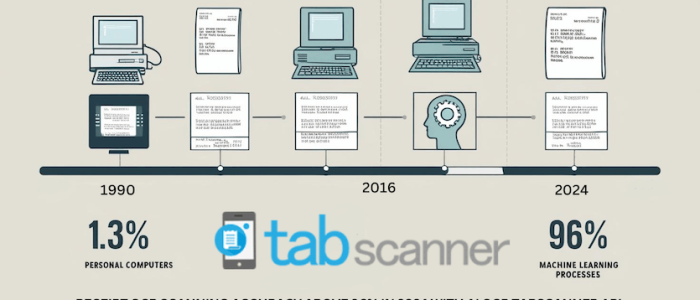

For example, receipt OCR can be completed automated using OCR scanning software and apps. No longer do accountants have to collate and save reams and reams of paper or tens or hundreds of Excel spreadsheets to accurately manage commercial finances.

Bill scanning optical character recognition allows accountants to take snapshots of expense reports. Data can then be automatically saved to the cloud and accurately pulled in for quick and efficient management. The days of manually typing numbers into columns are long gone!

Real-Time Advice Can Be Easily Achieved

Cloud-sharing technology allows accountants to share fiscal advice with their clients anywhere across the globe at any time with just a few clicks. This frees up much of an accountant’s time as they no longer need to carefully schedule meetings in traditional working hours to efficiently service all their clients.

Not only that, cloud accounting encourages collaboration and further solidifies client-accountant trust. Access to shared documents can be achieved in a matter of seconds, with real-time communication, and where applicable, advice and edits made to fiscal elements further cementing a transparent relationship.

This, in turn, frees up more time for accountants to develop prospective relationships with other clients, allowing them to expand their client base.

A Service for the Digital Age

Building on our previous point, cloud accounting allows accountants to offer a 24/7 service. In today’s digital age with emails, messaging apps, Skype and FaceTime, not to mention bill OCR technology, the days of the traditional 9-5, communication and information gathering delays are long gone.

Accountants should keep up an active presence on a range of online platforms. This shows commitment – something that existing clients will appreciate, and potential clients will gravitate to.

Social media platforms can be utilized to build brand awareness. Posting engaging and informative content, even proactively responding to comments and queries are both great ways of marking your service as one that stands head and shoulders above the competition.

Embrace Mobile Working

Learn and use the software and apps available and an accountant can streamline processes, save time and resources and focus on other areas of their practice.

Using an OCR receipt scanner to record and save expense data is much more efficient than manually typing numbers into a spreadsheet. Not only that, mobile working means that accountants don’t have to be confined to an office. In theory, they can work anywhere in the world and still offer the same superlative service to their clients.

Additionally, should accountants be responsible for performing comprehensive fiscal services for their clients, encouraging them to use bill OCR technology, such as a smartphone app, can make your job a lot easier – especially come tax season!

Adding Value with Receipt OCR

According to research, up to 80% of accountancy firms believe that adding value to the client experience is one of the primary ways to secure long-term growth.

Having a cutting-edge service – one that is lauded by clients – is one of the most effective ways to add value, keep a happy client base and grow an accountancy practice. Accountants should always be looking to implement new technology, such as an OCR receipt scanner for expense reports, to service their clients.

Listening to any feedback received and tweaking processes is a great way to evolve your accountancy practice into one that’s revered, not only in the surrounding areas but across a larger geographical demographic.

Remember the more value you offer your clients, the more likely they are to recommend you to colleagues and even friends. The more customers happy customers you have, the more likely your accountancy practice is to enjoy sustained success for years to come!

These are just a handful of ways that an accountancy practice can use receipt OCR and associated technology to grow their practice. How many are you employing?