Last Updated on January 9, 2025

It has been talked about for years. Leading commentators have had their say again and again. The fight has been analysed. Strengths assessed. Weaknesses highlighted.

Stamina. Influence. Momentum… Technique. Efficiency. Determination. No stone has been left unturned. Predictions have been made. Arguments taken place.

Just who will come out on top in the POS proof of purchase fight of the century? Will it be the journeyman, someone familiar who everyone knows and many still root for or will it be the slicker guy, who can innovate, adapt and who offers something new, different, contemporary?

It’s showtime. Let’s get ready to rumble. Will the dogged journeyman turn back the clock and prove that he still has what it takes, or will innovation prevail?

Let’s analyse the ultimate matchup: paperless vs. digital receipts.

Round One: Retail Opinion

In the later 19th Century, the NCR Corporation started to print paper rolls and accounting forms to help businesses to manage their finances better. In 1892, NCR developed the first proof-of-payment to accompany the mechanical register. Thus, the receipt was born.

Fast forward to 1914 and the demand for paper receipts had grown exponentially. The NCR Corporation grew to be the largest printing department in the United States.

Then in 1969, traditional bond receipts were replaced with newly introduced thermal paper receipts which removed the problem of receipts relying on expensive ink cartridges or ribbons for printing.

Instead, this heat activated printing method made printing paper receipts much more effective.

Throughout the continued evolution of technology, the paperless receipt cemented its position as the only proof-of-payment solution. For hundreds of years, retailers relied on paper receipts. There were no other contenders to the heavyweight crown. Until the last decade. Now everything has changed.

Despite the paper receipt being a seasoned stalwart of POS sales, time has crept up. Today, they’re no longer able to compete with digital receipts. They only thing left in the tank is familiarity.

Retailers are increasingly turning from paper receipts, preferring digital mobile receipt processing.

Moreover, digital receipts allow retailers to boost their online store traffic, maximize marketing potential and build social media communities. Better still, in our increasingly interconnected world, digital receipts can drive future interaction by embedded loyalty programs, website links and social media channels.

Marketing opportunities also give digital receipts a solid right hook that topples what printed receipts can offer. Special offers, upcoming events, competitors and a wealth of sales and branding opportunities can be leveraged to provide retailers with the opportunity to really pack a punch, get customers attention and turn buyers into brand advocates.

Round one goes to digital receipts.

Round Two: The Bisphenol A (BPA) Affect

You can’t talk about the drawbacks of paper receipts without mentioning BPA. Recent studies have shown that this endocrine disruptor (something that interferes with many bodily functions, including respiration, metabolism, reproduction, and sensory perception) can be absorbed through the skin.

Handling paper with a concentration of BPA leads to increased levels of in our bodies, which can have negative effects on our health. According to leading medical professionals, there is more BPA in a single piece of thermal paper than could be ingested from consistent use of a polycarbonate water bottle for years on end.

Research has linked BPA to an increased risk of breast cancer and prostate cancers, cardiovascular disease, and reproductive and brain abnormalities. Moreover, because BPA mimics the biological activity of estrogen, developing children are at a greater risk of being affected by BPA.

Conversely, OCR for receipt recognition allows for people and businesses to take a picture of their receipt and convert the data into a digital file. This eradicates the need for people to be exposed to BPA, making our world just that little bit safer.

Digital receipts allow for minimal, if any, contact with BPA. This significantly reduces the risk of people developing the health issues that BPA is so commonly associated with.

In January 2020, the EU banned the use of bisphenol A in the production of receipts. BPA can now no longer be legally produced or sold on the market in thermal paper in a concentration equal to or greater than 0.02% by weight. Whereas this is a step in the right direction, let’s not forget about the hundreds of millions of paper receipts with BPA that are still in circulation globally and will be for quite some time. Mobile receipt processing does not damage your health. At all.

Round two to digital receipts.

Round Three: The Environmental Impact

It’s estimated that annually as many as 300 billion receipts are produced at the cost of 25 million trees, 18 billion litres of water and 22 million barrels of oil. Now, given that biodiversity is decreasing, and climate change is accelerating, this seems ridiculously wasteful.

Now, there has been a concerted effort across the world to introduce recyclable receipts. This might seem to be a viable solution, but in the UK alone 7,300 tonnes of receipts printed every year cannot be recycled.

Moreover, the thermal receipts, which print through heat transfer, relying on BPA. Under no circumstances can these be recycled. So, in essence, the solution to using vast quantities of ink to print receipts (bisphenol A) is not only harmful to our health but is bad for the environment.

Digital receipts deliver an environmental knockout blow to paper receipts. A recent survey by Green America found that 9 out of 10 consumers would like an e-receipt as a proof-of-payment option at the very least, clear evidence that public opinion on PSO sales recordings is changing.

From a commercial perspective, businesses can position themselves are being dedicated to sustainability – something that has become increasingly prevalent in business operations across myriad of sectors over the last decade.

Then there’s resources. Businesses that leverage receipt recognition API in their operations will save much time. This allows them to provide better customer service and keep a tighter rein on their budget.

Round three goes to digital receipts.

Round Four: Business Cost

Let your guard down and runaway costs can soak up your profit. Whether for a start-up or multi-national conglomerate, every business needs to make sure that they work within the parameters of what they can afford.

But here’s the problem. Business costs can escalate quickly. From recruitment to operations, logistics to purchasing, regardless of whatever your business is, trading within a set matrix that encourages a consistent stream of revenue, calculating, hopefully, profit and not loss, is paramount to prosperity.

There are many expenses that different businesses need to factor. From the rental cost of a physical property to the cost of employing your workforce month after month. Marketing costs like building and maintaining a website and social media presence, incorporation fees, corporation tax… the list goes on.

A profitable business is led by decision-makers who understand the market, their business, customers, competitors and their product(s) or service(s) inside out. They take risks, may even bet on an underdog, but in the end, they believe that what they’re doing is right.

So, how does all this relate to POS receipts? Well, it costs money to print paper receipts. Much more than you make think. Businesses need an infrastructure to take payments. This can be a card terminal or cash register with separate receipt printer attached to the terminal.

You think all this hardware is cheap? No. It isn’t. And, what if you own physical stores, twenty of them, each with five card terminals or cash registers? You’ll have to pay for one hundred card terminals and cash registers!

Then you all the cost of paper rolls for printing receipts, possibly occasional maintenance if something breaks down. Suddenly, business owners begin to see their profit margins getting slimmer and slimmer.

Now, let’s compare the cost of digital receipts. For starters, business owners don’t need to factor the cost of printing materials into their budgets. The average cost of a paper receipt can cost anywhere between $0.015 to $0.5. So, a merchant printing 1000 receipts a day spends between $5,475 and $18,250 per year just on printing receipts!

Cash registers and card terminals also don’t come cheap. A quick look on Amazon and you’ll find that the Epos Till System costs $800! Now imagine that you need four in every shop… and you own twenty shops. That’s $80,000! Just for a cash register.

Now, of course, cash registers can vary in price. But if you were to buy a cash register for half the cost of the Epos Till System, you’d still have to pay $40,000 just to set up payment infrastructure. And we’ve not even got to card terminals.

A quick look only and you’ll see that card terminals cost anywhere from $60 to $200. Let’s be fair and say that business owners pay $120 for a card terminal. Let’s say again that you need four in every shop and that you have twenty shops, the cost quickly adds up to $9,600!

Again, of course card terminals do vary in price. But when you compare this to the cost of having a digital receipt infrastructure with mobile receipt processing with the best receipt recognition API where you might pay $400 a month and get myriad of insights and benefits vital to your business operations. Can you honestly say that having a digital receipt infrastructure is not the best decision?

Just one more thing… what happens if your cash registers or credit card terminals require maintenance or replacing. How much will that cost?

Round four goes to digital receipts.

Round Five: Expense Management

Now we come to the final category in out matchup between the POS champion and the challenger to the throne: managing our expenses. Will paper receipts be boxed into a corner, their arms guarding against a flurry of combinations thrown their way or will digital receipts hit the canvas in the final round.

Let’s find out.

Okay, so paper receipts have history on their side. They have long been the best way for accounts management departments to calculate and reimburse business expenses. But the process is also floored. Very floored.

Receipts can be ripped, crumpled, even lost. And without a receipt that clearly states expenditure, the amount cannot be reimbursed. Imagine for a second if you’ve made a purchase worth thousands of dollars only to lose the receipt and compromise the reimbursement. Sounds like a rookie mistake but it happens. More often than you might think. Paper receipts are quite easy to rip, crumple or accidentally lose.

But what about digital receipts. Well, thanks to OCR for receipts recognition, you never have to worry about ripping, crumpling, or losing receipts ever again. Receipts can be captured with any iPhone camera and uploaded to the iCloud, where they’ll be safely stored forever. This makes managing expenses so much easier.

But that’s not it. Buy the right receipt recognition API and businesses can get access to a wealth of additional features that streamline and improve business processes. From an analytics dashboard that provides valuable insight to API key management that secures fiscal information online.

There there’s the reduction of paper clutter, more efficient time management, mobile management of expenses and reimbursements, expense reporting, encrypt and sharing data with the touch of a button, easily matching receipts with transactions swiftly, and much, much more.

Round Five goes to digital receipts.

Conclusion: A One-Sided Contest

It’s unanimous. Digital receipts take the bout. The title. Won every round. With ease. The two contenders have slugged it out leaving the judges with little doubt who is the victor.

Modern mobile receipt processing is here. Business can categorically provide a service that meets the demands of a digital commercial marketplace whilst not worrying about any long-term effects of exposure to harmful BPA.

They can confidentially say that they operate a sustainable and environmentally responsible business, echoing a progressive approach to business practices and save money.

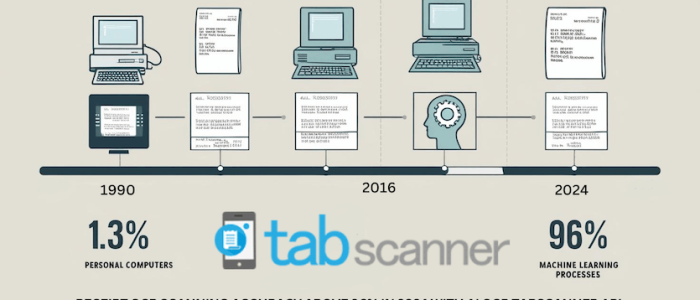

But more than that with the receipt recognition API like that used by Tabscanner, businesses can streamline practices, drastically improve colleague and customer engagement, and have access to a set of metrics that allows them to effectively manage expenses wherever they are in the world.

Neither contender pulled their punches but in the end, paper receipts just didn’t have enough in the tank to get the job done.

Digital receipts is the undisputed winner.