Last Updated on November 24, 2024

The emergence of cloud computing has been one of the biggest game changers in the accountancy sector e.g. cloud receipt processing. The impact that the cloud has had on commercial activities have been expansive. This has been particularly felt in the accounting profession. The role of an accountant has evolved, many accountants operating today choose to work in an advisory capacity.

Despite the relentless pervasive nature of the cloud, it’s not uncommon for clients to broach the possibility of switching to cloud accounting with an air of trepidation. It is the role of an accountant to reassure clients of the merits of evolving technology. This includes a range of applications, from utilizing a receipt scanner to manage expenditure to using the cloud to back-up and share important documentation.

Here’s a short look at the three-step guide that all accountants should follow to prepare their clients for cloud computing.

Cloud Receipt Processing Benefits

Before any business adopts a new process, they should understand why. This is where stressing the benefits of cloud receipt processing comes into play. Research has found that those businesses who adopt cloud computing grow 26% faster than those that don’t.

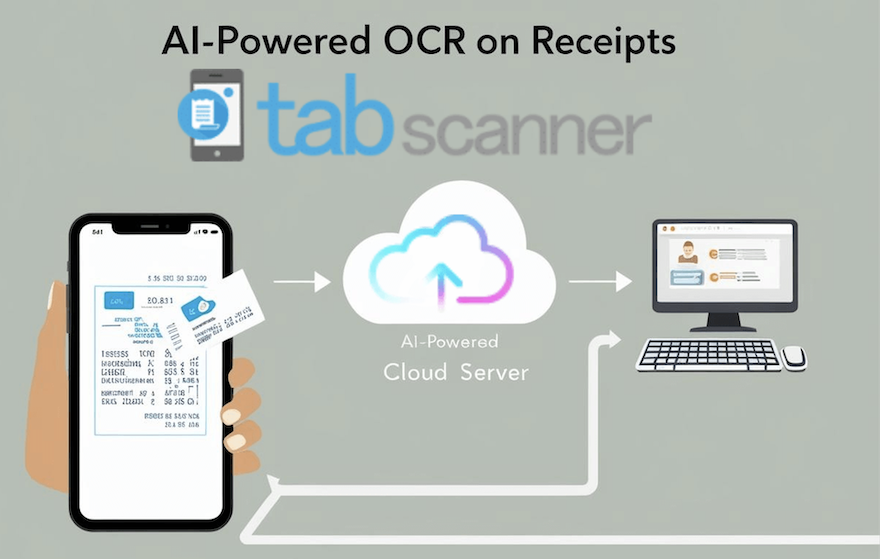

But, why is this? Cloud computing streamlines and increases workflow processes whilst offering complete transparency and offering shared access to vital documents anywhere in the world – from multiple devices. From uploading fiscal information, gleaned from a receipt scanner to offering the safe storage of all documents, the cloud is an IT paradigm that will save you time and money.

Indeed, those that use the cloud have reported a 21% increase in their profits. The cloud is also a cost-saver. Businesses of all descriptions have an 80% saving on expenditure. Cloud receipt processing is the future.

Still not convinced? Let’s break the benefits down. The cloud gives users the ability to check their accounts and perform payroll functions using any device with an internet connection. Real-time information can be achieved, and labour-intensive tasks can be fully automated. Not only that, you’ll never have to worry about losing files or your hard drive failing and losing vital work!

Create an App or Software for Cloud Receipt Processing

Once your clients are fully aware of the benefits, it’s time to create tailored profiles for each to maximise the benefits to them. Which clients are tech savvy? Which clients will take a cautious approach to any operational changes? Which are likely to be hesitant or even resistant to operating changes?

Tech-savvy clients, such as those who have a broad understanding of the cloud and receipt OCR technology, for instance, are likely to be highly amenable to the changes. App and platform-friendly clients will be, more than likely, impressed by your practice’s progressive nature and be pleased that you’re providing them with a cutting-edge level of service. This will encourage a seamless transition.

Those cautious clients may seek out further guidance before your planned implementation. It’s important to reassure these clients, emphasising cloud benefits and that its integration into business operations will allow you to provide clients with an enhanced level of service.

It may be best to slowly integrate cloud computing, starting with a receipt scanner app and evolve applications over a short period. This will allow your clients to become comfortable with the cloud and clearly see the benefits to them.

For clients who have steadfastly resisted technology, you might be best to leave them out of the first iteration of your planned cloud implantation. You don’t want to overwhelm them. However, you can still tell them of your planned cloud implementation, and you never know, they may just come to you, make enquiries and switch to cloud computing in no time!

Choose the Best Cloud Based Receipt API

Once you’ve profiled your clients, the next stage is to decide which approach to cloud conversion is best-suited to the individual client. This way you can identify the level of guidance and training they’ll need to feel comfortable.

A good way to do this is to visualize a transition path. Just as you would implement a receipt OCR expense app roll-out, it’s paramount that you have an onboarding plan and to stick to it. Always communicate individual fiscal and operational incentives that will appeal to your individual clients, otherwise, they might be left wondering what’s in it for them.

As surprising as it may sound, according to research from the Cloud Industry Forum (CIF), as of March 2017 88% of businesses have adopted cloud services in one form or another.

This means that it’s likely that a significant amount of your clients will already be cloud-savvy and be open to switching – provided that your clear and transparent in all your communications. Regardless of this, before you switch, it’s paramount that you guide them through the process and tell them of the planned date of implementation.

For those cautious clients, keep stressing the benefits of the cloud and how you’ll be able to provide them with a better level of service. Also stress the benefits of a receipt scanner. You could use this time to help them to better understand the how to use a receipt scanner. You’d be surprised just how often the client’s hesitant to change become permissive and willing through considered communication.

Tech-resistant clients have the potential to delay cloud adaption for as long as possible. Don’t worry though. It may be best to postpone any planned implementation until you have implemented cloud computing to all your willing and comfortable cloud-savvy clients. In the meantime, continue to stress the benefits of cloud computing, be open to their questions and consider how best to incentivize them in the future.

Without a doubt, cloud computing is revolutionising commercial activities. Adopting a cloud-centric service will show your customers that you’re a modern, progressive practice – one that’s focused on improving your level of service. With these traits, it’s hard for any of your clients to argue against the superlative nature of your service!