Last Updated on January 9, 2025

It’s not hyperbole to say that Cloud-based accounting applications has driven an increased demand for, and therefore is, one of the most important factors in the decreased demand for businesses for paperless receipts. The limitless storage capacity, easy accessibility, and the fact that by the year 2019, it’s estimated that there will be 2.5 billion smartphone users in the world. *

With such a vast range of users worldwide, it should come as little surprise that every day new and evolving technology emerges onto the mobile landscape to enrich our lives. One of the more noteworthy innovations of recent years is bill OCR (optical character recognition) for receipt scanning.

If you’re unfamiliar with this technology, or unconvinced as to the true benefits of using a mobile receipt scanning API app, here are four advantages of keeping digital receipts that you need to know.

Less Time, Less Stress

It may seem somewhat obvious, but bill OCR through efficient receipt scanning makes keeping track of your finances so much easier – and less stressful. Not only is keeping track of your financial expenditure prudent for shrewd financial planning, but it can come in handy come tax time.

When preparing tax returns, one of the most arduous tasks is sorting through and organising your receipts. Scanning and saving your receipts to the Cloud makes them far easier to organise – saving you a great deal of time.

Not only that but, the stress of finding receipts, searching through files, drawers and pockets is completely alleviated. Come time to prepare your tax return, you’ll be glad that receipt scanning allows you to effortless find that all-important receipt, invoice or OCR cheque.

Merchants Love Digital Receipts

Let’s be honest now, digital receipts are highly attractive to merchants. They provide an excellent marketing opportunity to promote their brand, products and services to consumers.

In addition, digital receipts recorded by bill OCR allow merchants to reduce the cost of purchasing the paper and toner cartridges required to provide customers with a paper receipt.

This makes the use of printers in an office redundant, saving money and the environment. Emailing receipts is quick and easy – and all records of the transaction can be easily logged and accessed by a wealth of devices, anytime, anywhere.

You Only Need an App

Online accounting software, such as Quickbooks, allows users to sync their expenses having scanned receipts using bill OCR. All pertinent data is extracted meticulously, with a record of all transactions and the amounts accurately recorded.

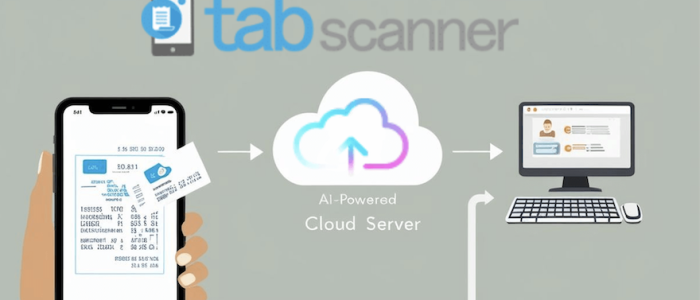

The continuing evolution of this technology is evident with mobile receipt scanning apps, like Tabscanner. The app allows you to capture, store and organise your receipts all in one place – making keeping track of your finances easy and accessible.

Powered by the world’s most advanced API, Tabscanner provides optimal bill OCR by individually scanning each line element and accurately calculating expenses.

Whether you’re looking for a way to accurate keep track of your personal finances, or must manage a wealth of business expenses, appropriately reimbursing employees every single month, Tabscanner is the one OCR cheque and bill platform that you shouldn’t ever be without.

Sources:

https://www.statista.com/statistics/330695/number-of-smartphone-users-worldwide/

https://tabscanner.com/blog/ocr-for-receipts/